Monthly:September 2015

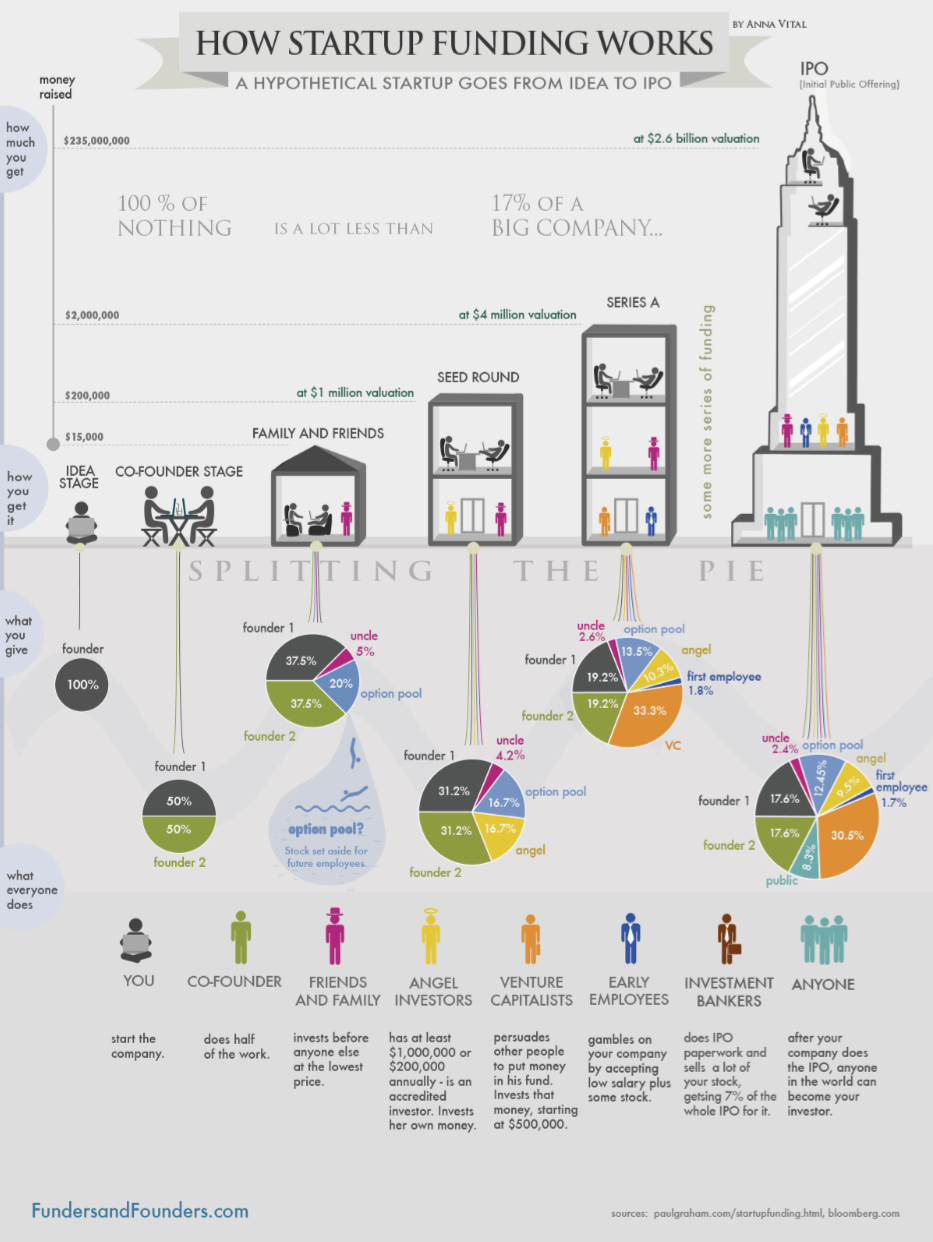

Startups and their highly innovative potential (Bundesregierung 2013, bundesregierung.de) are considered to be of great importance for the economic development in the US, Asia and Europe due to their unimaginable scale effects and enormous valuations as well as their high media attention (Austin, Canipe, Slobin 2015, wsj.com). This paper will provide an overview of means for international startup funding and will examine current changes in startup funding and developments in regards to concern about a new dot-com bubble. -> tl;dr Startups and […]

I really like vintage Ford Mustang muscle cars from 1965-69. Here are some insignia shots of the 1965 Mustang Convertible I wrote about earlier as well as a glance at the “1965 Registered Owner’s Manual”. Don’t they look just awesome? I especially like the manual. It is far more fun than any contemporary car manual I have ever seen. Ford Mustang’s have been built ever since 1964 and created the term “pony car” as a class of American automobiles with long […]

A week ago I decided to move my Tumblr blog to WordPress using the Tumblr importer plugin. I moved the blog for various reasons, more possibilities for customisation being among them. Ever since 2010 I only used Tumblr because of its easy of use. In 2012 I started using moritzrecke.com as a custom domain with my Tumblr blog. Since I didn’t want to loose old content or the corresponding URLs on my domain, I wanted to migrate all posts. Tumblr importer WordPress offers an […]