Startup funding and signs of a new dot-com bubble

Startups and their highly innovative potential (Bundesregierung 2013, bundesregierung.de) are considered to be of great importance for the economic development in the US, Asia and Europe due to their unimaginable scale effects and enormous valuations as well as their high media attention (Austin, Canipe, Slobin 2015, wsj.com). This paper will provide an overview of means for international startup funding and will examine current changes in startup funding and developments in regards to concern about a new dot-com bubble.

Startups and their growth path

The term “startup” is most common for young, newly founded companies and well established in the mainstream media since at least the dot-com bubble in 2000. But not any new company constitutes a startup. Startups are characterised by low seed capital and the goal to implement an innovative business model (Bundesregierung 2013, bundesregierung.de) that can be easily replicated in order to scale the business quickly (Blank 2012, steveblank.com).

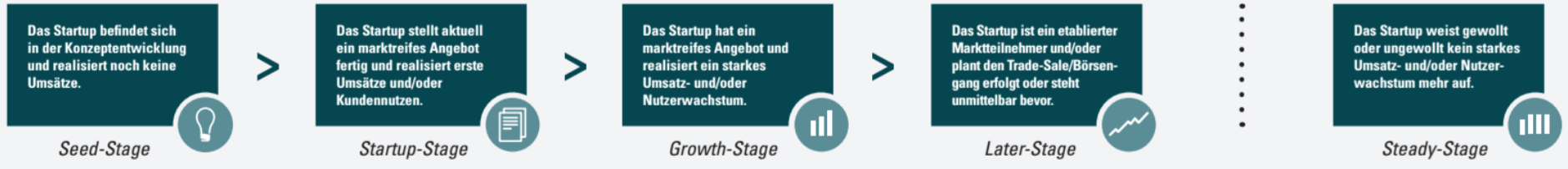

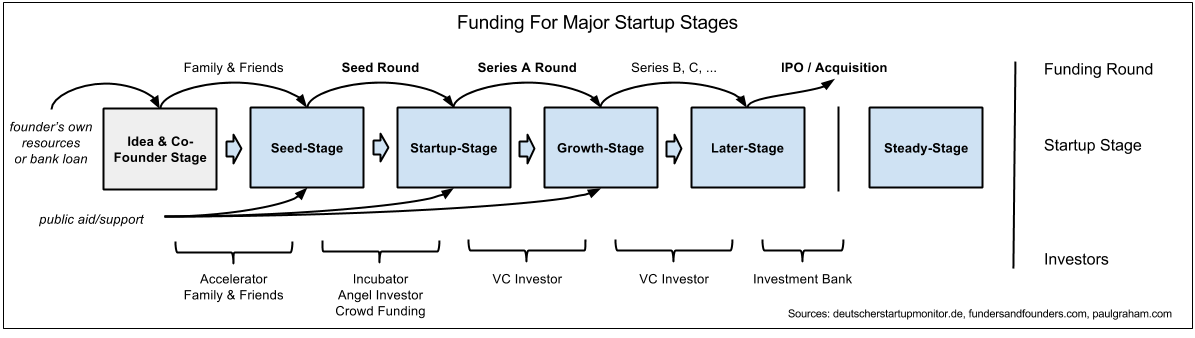

For a better understanding of the possible growth path for startups, the approach by the German Startup Monitor (Deutscher Startup Monitor), initiated by the Bundesverband Deutsche Startups e.V. (BVDS) can be used. The model distinguishes 5 phases: the “Seed-Stage” as a conceptional phase, the “Startup-Stage” with a working product and first revenues/users, the “Growth-Stage” with a mature product and strong growth, the “Later-Stage” with a planned sale or IPO and the “Steady-Stage” as a stagnation phase (DSM 2014, p. 14, Kohlmann 2011, p. 90, Ripsas 1997, p. 133)

A scalable business model is at the core of a startup and needs to be examined for its potential for success at preferably lowest cost. If the business idea assumption is verified, the continued success of the business model is highly dependent on market situation and the ability to adapt the product in the process. Typically this requires much larger funds and therefore different kinds of funding than before (Kollmann 2011, p. 90).

Startup funding

Startups are dependent on different kinds of funding in their growth stages. In addition to financial means other aspects of support like consulting, networking, access to markets etc. are essential. Also the particular interests of all people involved (e.g. founder, employees, investors, banks, etc.) need to be considered (vgl. Ripsas 1997, p. 133)

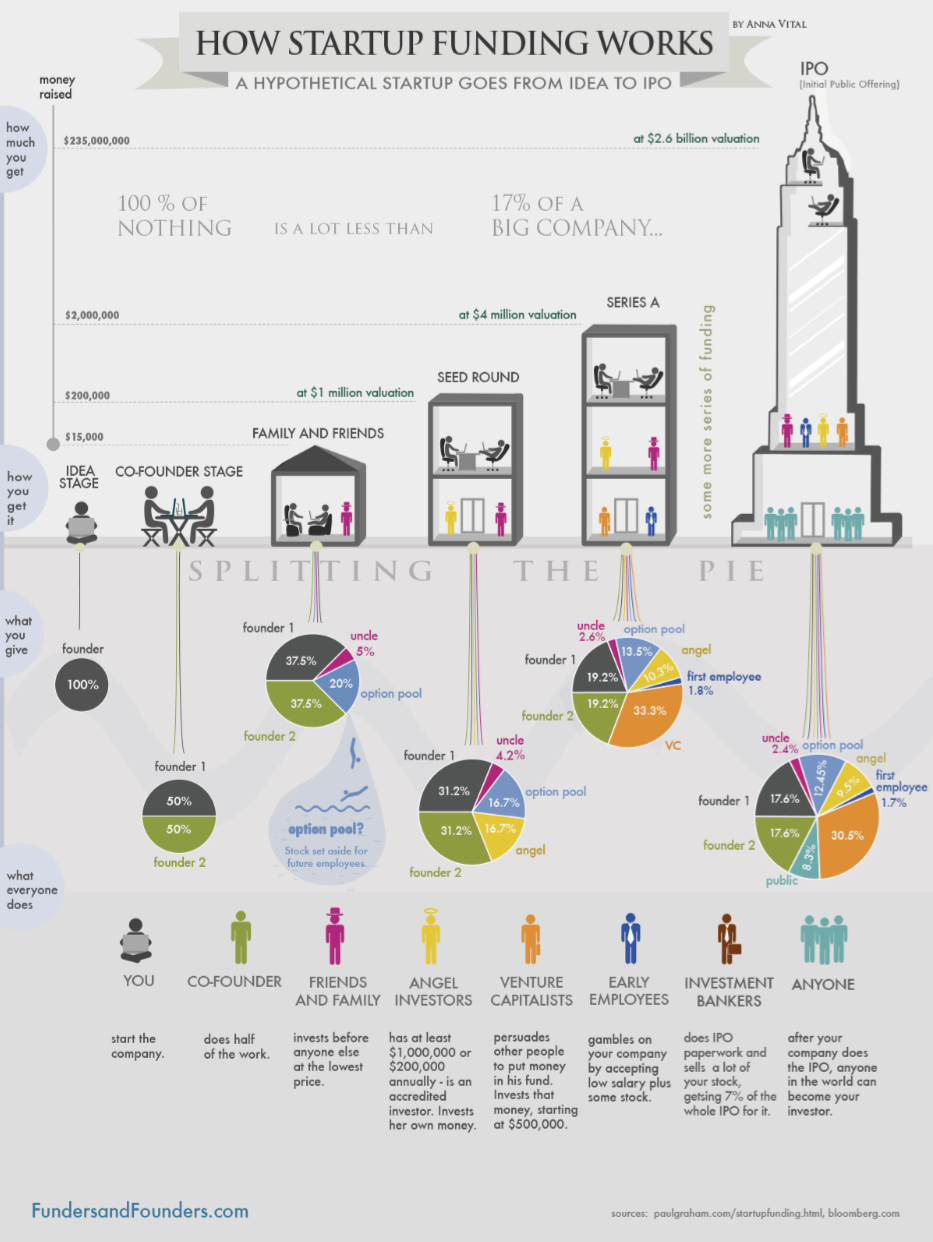

During its lifetime a startup potentially runs through many rounds of funding to reach the next stage of growth. These rounds can be described as “Seed Round” and “Angel Round”, typically after starting the company, and “Series A Round”, enabling the company to scale towards a possible IPO or sale of the business (Graham 2005, paulgraham.com).

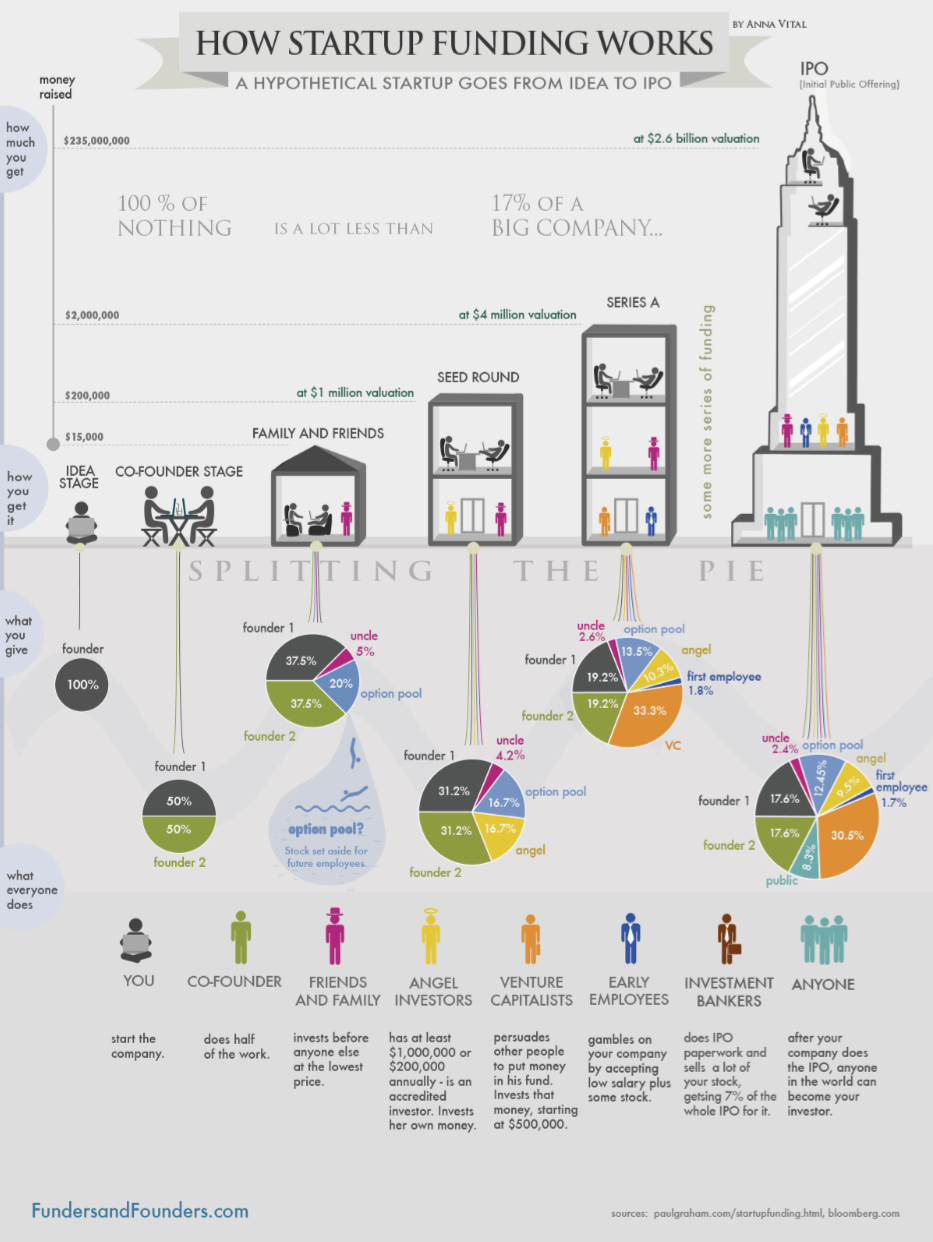

Considering the shareholders of the startup in each stage, the process of continually changing equity structure can be described in stages such as “Idea Stage”, “Co-Founder Stage”, “Family & Friends” and “Seed Round, “Series A” as well as an “IPO” as the final stage (Vital 2013, foundersanddounders.com).

Starting the company: Idea & Co-Founder, Family & Friends Stage

As shown in figure 2, a startup starts out with its founders, in most cases equally sharing the equity. The first five-figure capital requirements are usually met with their own money, via bank loans or through their family or personal peer group.

If the startup decides no to go with a bank loan, a new shareholder structure for the company is established, making “Family ” Friends” the first investors in the business. This might lead to problems down the road due to the lack of investment experience, nevertheless it is a very common form of first funding for startups (Graham 2005, paulgraham.com).

Another alternative are so called accelerator’s, offering a five-figure to low six-figure investment for usually 5-7% in equity of the company and allowing startups to participate in a typically 3 month program to get prepared for the next round of funding (Altman 2014, ycombinator.com und Springer 2015, axelspringerplugandplay.com). During this period the startup can make use of the accelerator’s offices, coaches, market insights and workshops. After completing the program and showing off the developed product during a “Demo Day”, the startup leaves the accelerator. Slots within these programs are highly limited, so there are demanding application requirements to be met. Accelerators are usually private companies with their managers being angel investors themselves (Cohen 2013).

Some of the most important accelerators (The Economist 2014, economist.com) are Y Combinator (USA, ycombinator.com), TechStars* (USA, techstars.com), AngelPad (USA, angelpad.org), 500startups (USA, 500.co), Seedcamp (UK, seedcamp.com) und Startupbootcamp (EU, startupbootcamp.org) among many others. In Germany there are accelerators operated by Axel Springer (axelspringerplugandplay.com), ProSiebenSat.1 (p7s1accelerator.com) as well as the German Accelerator (germanaccelerator.com) and the Next Media Accelerator (nma.vc).

In addition startups can apply for aid or sponsorship from official funds. The number of support programs is extensive. In the EU and Germany alone, there over 2,000 specific programs for startups (FÜR-GRÜNDER.DE 2015, fuer-gruender.de). The programs can be divided between special loans, aid money, investments and non-cash benefits. The German business development bank KfW offers advantageous loans, provides grants for consulting services and provides access to equity capital (KfW 2015, kfw.de) via the High-Tech Fonds (High-Tech Gründerfonds), financed by the German Federal Departement of Commerce (Bundesministerium für Wirtschaft und Energie) and 18 major German corporations (High-Tech Gründerfinds 2015, high-tech-gruenderfinds.de). In addition there are the founder aid program (Existengründerzuschuss) and the founder scholarship (EXIST-Gründerstipendium) as well as regional business development programs within the federal states of Germany. All these possibilities for aid provide support for any startup growth stage and will not be discussed in further detail (FÜR-GRÜNDER.DE 2015, fuer-gruender.de).

If a startup manages to secure a first round of financing either trough their founder’s means, Family & Friends or an accelerator program, it reaches the “Seed Stage” in terms of the model by Deutscher Startup Monitor (DSM 2014, p. 14). It is also common to set aside an options pool for selected employees, who consider a rather small salary and join the company for the personal opportunity to shape its future. These employees also hope for a substantial growth in value of the company for a potential exit in the future (Vital 2013, foundersanddounders.com).

Seed Round

The “Angel Round” and “Seed Round” mentioned by Graham are shown as “Seed Round” in figure 2. The most important aspect of this round of funding is the six-figure to low seven-figure size of the investment. Angel investors, also called business angels, are often entrepreneurs investing their own private money and supporting the startup through their personal network. Beneath angel investors and angel syndicates there are also seed funding firms, usually called incubators (Graham 2005, paulgraham.com).

Incubators work in a similar manner as accelerators, but with much larger investments and higher equity shares. They provide more support during the buildup of the company, e.g. by providing access to developer teams or marketing assets. A startup usually stays within a incubator program for one to five years and has to go through a challenging application process as well. Incubators are often associated with venture capital investors and are operated by managers that are not necessarily active investors (Cohen 2013).

Companies such as Microsoft (US, microsoftventures.com), Deutsche Telekom (DE, hubraum.com) and Telefónica (EU, wayra.co) are operating incubators. Some others are idealab (USA, idealab.com), Rocket Internet (DE, rocket-internet.com), Team Europe (EU, teameuopre.net) and Project A Ventures (DE, project-a.com).

Over the past years more options for funding came up. Platforms like AngelList (US, angel.co) enable startups to make direct contact with potential investors. In addition crowdfunding became quite popular, enabling people to preorder products that still need to be produced on platforms like kickstarter (US, kickstarter.com) and indiegogo (US, indiegogo.com) or enabling people to invest in companies on platforms such as fundersclub (US, fundersclub.com), fundsters (DE, fundsters.de) or seedmatch (DE, seedmtach.de).

If a startup manages to secure a seed round, it reaches the “Startup Stage” in terms of the model by Deutscher Startup Monitor (DSM 2014, p. 14).

Series A

The “Series A Round” in figure 2 is a placeholder for more substantial seven-figure or larger investments. In this round specialised venture capital investors, also called VCs, are using their investment funds to buy large shares of the startup. Typically a VC holds at least 33% of a company and will have a much more prominent role in the strategic direction of the company (Graham 2005, paulgraham.com).

Some of the top VC investment firms in the US are Andreessen Horowitz (a16z.com), Khosla Ventures (khoslaventures.com), SV Angel (svangel.com) and Accel Partners (accel.com) of which several are actively investing in Europe as well (Benedicto Klich 2014, entrepreneur.com). In Germany the most important VC firms are Bertelsmann Digital Media Investments (bdmifund.com), e.ventures (eventures.vc), Holtzbrinck Ventures (holtzbrinck-ventures.com) and T-Ventures (t-venture.de) among others (Li 2013, venturevillage.eu).

After a successful Series A round of funding, the startup reaches the “Growth Stage” in terms of the model by Deutscher Startup Monitor (DSM 2014, p. 14). The immediate goal is to accelerate the startup’s scale process for a optimal growth in value and to prepare the company for a sale or an IPO, also called exit. On this path many more rounds in funding are possible and often common. These are called Series B, Series C etc.

IPO or acquisition

An Exit after a Series A round (or any other subsequent round) can be accomplished via an Initial Public Offering at the Stock Exchange, also called IPO, or via an acquisition of the startup by another company (Vital 2013, foundersanddounders.com). With an acquisition all shareholders can sell their shares, liquidating their equity. With an IPO, which is typically made possible with a large investment bank, the shareholder can sell their shares publicly for the first time as long as they are not bound by any contracts or vesting regulations. Until one of these exit scenarios is met, the sale of equity is rather difficult and can usually only be made to other investors (Graham 2005, paulgraham.com).

If a startup is working in a IPO or is an acquisition candidate, it has reached the “Later Stage” in terms of the model by Deutscher Startup Monitor (DSM 2014, p. 14). If the exit is implemented, the company ceases to be a startup.

Figure 3 shows the entire process of possible funding rounds as described by Graham and Vital in context to the model by Deutscher Startup Monitor. The “Steady Stage” as a stagnation phase has not been discussed in terms of startup funding.

Significant changes in startup funding

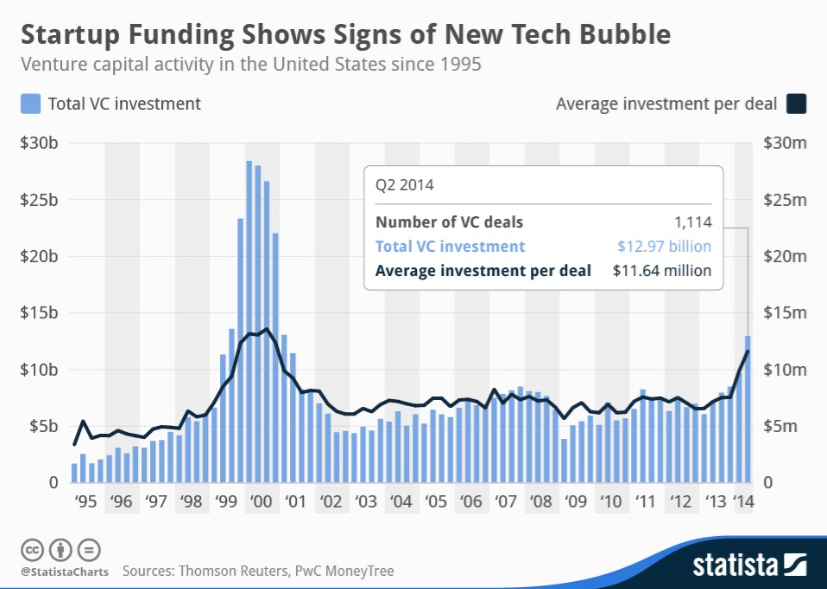

Looking at investments made by venture capital firms in the US, investments decreased rapidly after the dot-com bubble in 2000. But over the past years the investments grew steadily despite the economic crisis and a short setback in 2009 and show a distinct increase compared to the 1990ies. In 2014 a very substantial growth in investments can be identified as shown in figure 4. This rapid change causes concern about a new dot-com bubble.

Signs of a new dot-com bubble

The venture capital investments of $ 12.97 billion in Q4 2014 are the highest ever since Q1 2001 and grew 81% in Q2 2014 compared to Q2 2013. This represents the largest growth in year-to-year comparison since Q3 2000. In addition the average investment size of $ 11.64 million in Q2 2014 is as high as in Q4 2000 (Richter 2014, statista.com).

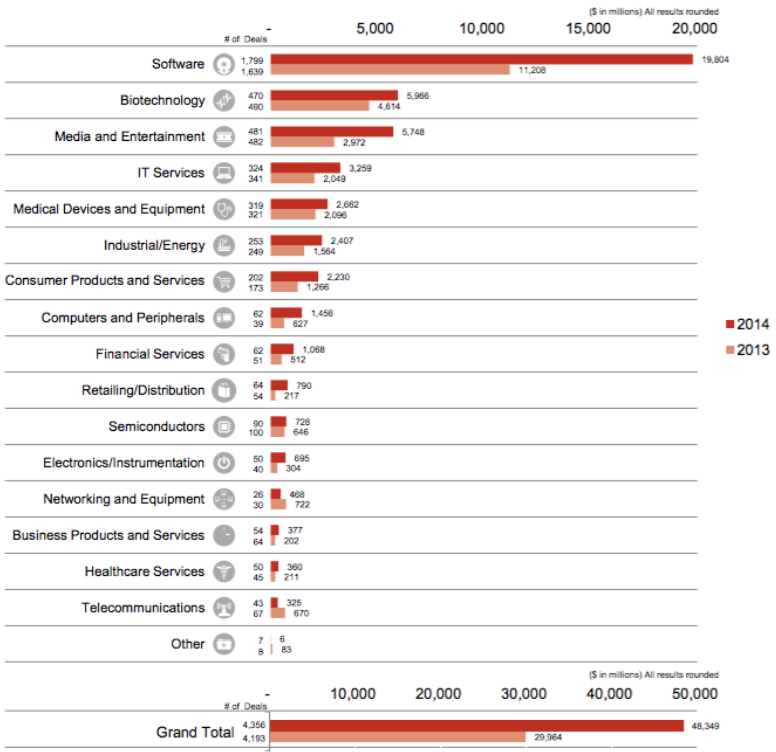

Investments differentiated by industry show the software sector is outpacing all other industries. In 2014 this sector reached the highest investments since 2000 with $ 19.8 billion, making up 41% of all investment, the largest share since the beginning of the yearly MoneyTree Report in 1995 (PwC 2015).

These market movements are highly reminiscent of 2000. In addition acquisitions of companies like WhatsApp with an valuation of $ 345 million per employee are leading to concern as well, since metrics like this were common for investments just before the dot-com bubble burst on the turn of the millenium (Heskett 2014, hbs.edu).

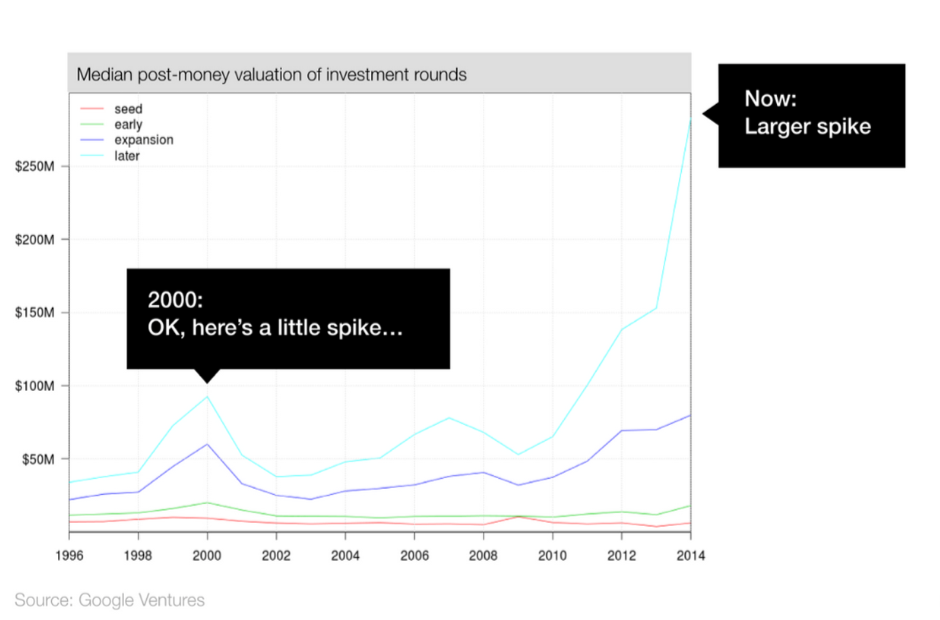

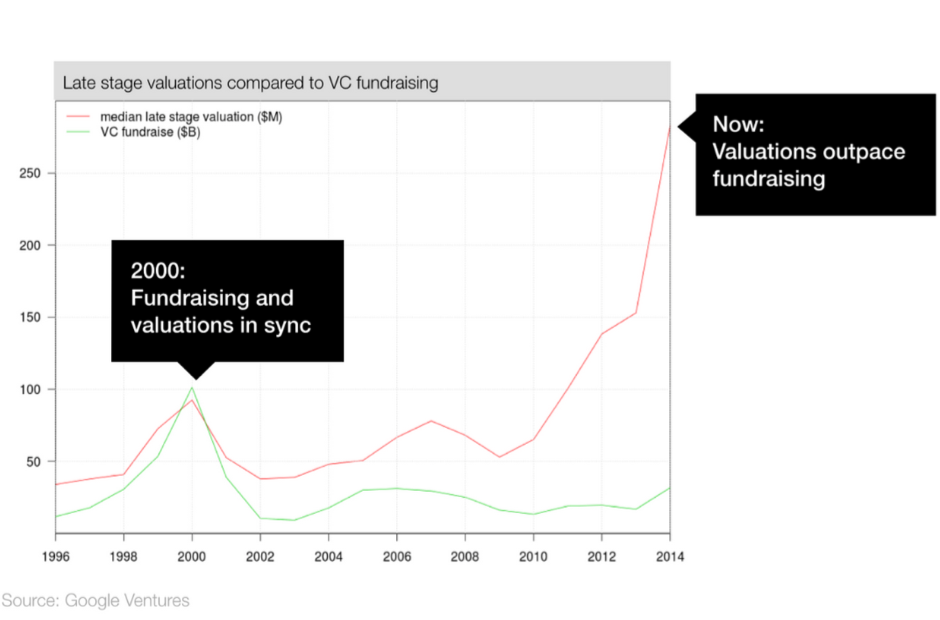

Another indication for a new bubble might be the average valuation of startups, which already exceeded the values of 2000 in 2012 considerably (figure 6). Furthermore the valuations are rising faster than investments (figure 7). Also the average valuation at the time of the IPO is not growing as fast as the “Later-Stage” valuation. This proportion is deteriorating since 2009 and leads to shrinking returns on investment (ROI) for investors joining a startup in a later stage (Maris 2015, techcrunch.com).

Differences between the dot-com bubble in 2000 and today

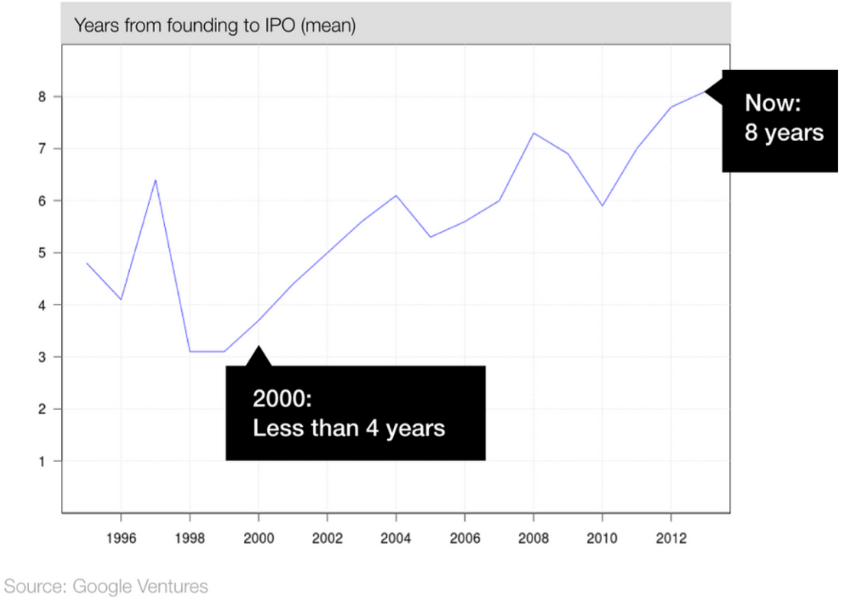

Nevertheless, there are some distinctions to the developments from 15 years ago. The total sum of investments in 2014 is just at 1/3 of the sum in 2000. In addition many companies went to an IPO much quicker than today (figure 8).

Also many classic IPO candidates are bought by companies such as Google these days. Among many things this is also due to stronger regulation, e.g. “Sarbane-Oxley Act” from 2002, providing compliance obstacles for smaller companies. In addition “Regulation Fair Disclosure” from 2000 lead to considerable requirements and risks for the information policy of publicly traded companies, making a premature IPOs far more unattractive (Lee 2014, vox.com).

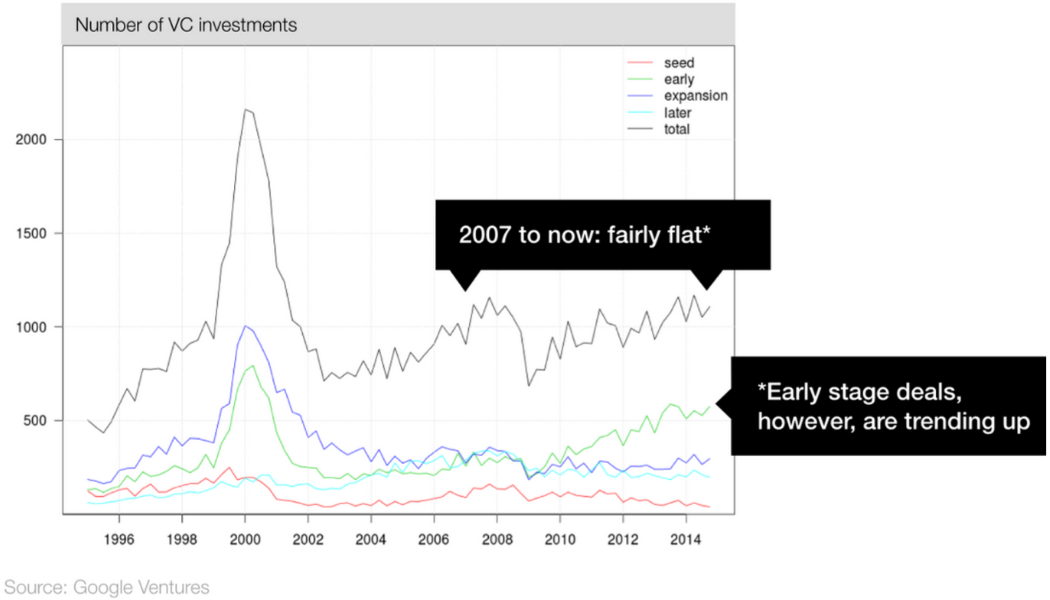

In addition, VCs made more than 2,000 investment in the year 2000. Over the last few years the number of investments is between 1,000 and 1,200 (figure 9). This indicates that investors are far more picky and concentrate on fewer but much larger deals. Even when considering the growth of investments in 2014, the number of deals remains stable (Maris 2015, techcrunch.com).

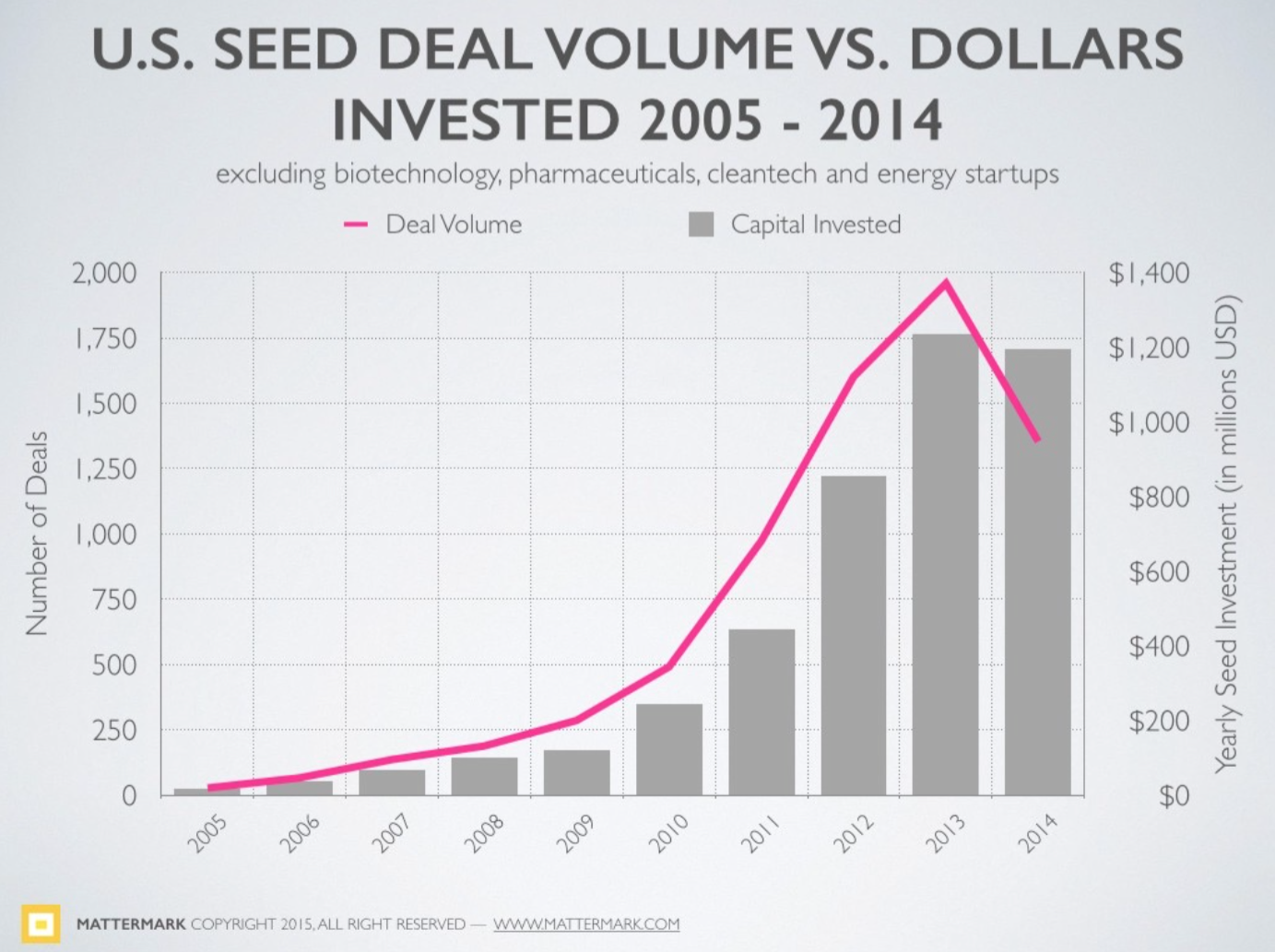

The number of seed round funding did in fact shrink in 2014 with a stagnating overall investment sum (figure 10). Investments are moving towards more Series A rounds and average investment sums are rising. This indicates that the early stage investment boom is cooling of (Morrill 2015, mattermark.com).

The huge growth of investments in startups can also be attributed to the stable and long-lasting low interest rates ever since the financial crisis in 2008 and the continuous market flooding with cheap money. In order to achieve attractive returns (interest rate), far more high-risk investments need to be made. This directly correlates with the high startup valuations over the past years.

Therefore further growth of the startup industry and the correspondent investment industry can be expected as long as the interest rates remain low and the economy is not recuperating considerably (Wilson 2014, avc.com).

Conclusion

With the shown market data and media reports it is obvious that the startup industry and its investment industry is still booming will continue to do so for the time being. Due to the low interest rates the investment sums can not be expected to flatten any time soon.

The options for startup funding did evolve considerably over the past few years. Therefore conditions for starting a startup have never been better. This also explains why there are more startup than ever before and leads to fierce competition and overall no better chances for success. This is also acknowledged by investors who are increasingly willing to invest larger sums but are very choosey while at it.

There is another trend which might be very interesting for the future, micro startup acquisitions. Established former startups such as Facebook, Google, Twitter and Apple but smaller startups as well such as Pinterest are buying tiniest startups with team sizes as small as 2 people. This is radically different from usual acquisitions of established products or revenues. The goal is rather to gain access to talent, product prototypes or innovative potential of these small teams (Paka 2015, techcrunch.com). For many founders this might actually be one more additional option for an early exit.

The risk of a new dot-com bubble is raising concern with many experts. However the surrounding conditions are very different from 15 years ago. Even if the system would crash and the new bubble would burst, the mechanics of the crash would be very different from the dot-com bubble in 2000.

Due to the recent trends in 2014 and the sudden rise in investments, the developments of 2015 need to be monitored to collect more indications for or against a new dot-com bubble. As of now there are scattered concerns but concrete indications for a foreseeable burst have not surfaced.

tl;dr

Even if a new startup bubble would burst, the mechanics of the collapse would be largely different from the dot-com bubble in 2000.

DISCLAIMER: This paper has been written for the seminar “InnovationCity 2030″ within the “Next Media” master program at the University of Applied Sciences Hamburg (HAW Hamburg) in May 2015. Supervising Professor: Prof. Dr. Kai von Luck. For more information or any questions please contact me at mail@moritzrecke.com.

Sources

Altman 2014 – Altman, Sam: Y Combinator Posthaven. Retrieved: 30.04.2015.

Austin, Canipe, Slobin 2015 – Austin, Scott; Canpie, Chris; Slobin, Sarah: The Billion Dollar Startup Club. Retrieved: 27.04.2015.

Benedicto Klich 2014 – Benedicto Klich, Tanya: VC 100: The Top Investors in Early-Stage Startups. Retrieved: 30.04.2015.

Blank 2012 – Blank, Steve: Search versus Execute. Retrieved: 25.04.2015.

Bundesregierung 2013 – Die Bundesregierung (Hrsg.): Internet-Start-Ups: eine neue Gründerzeit. Retrieved: 25.04.2015.

Cohen 2013 – Cohen, Susan: What Do Accelerators Do? Insights from Incubators and Angels. veröffentlicht in innovations, Summer-Fall 2013, Vol. 8, No. 3-4, Pages 19-25.

DSM 2014 – KPMG (Hrsg.): #DSM : Deutscher Startup Monitor 2014. Retrieved: 29.03.2015.

FÜR-GRÜNDER.DE 2015 – FÜR-GRÜNDER.DE: Fördermittel für Existenzgründer und Selbstständige. Retrieved: 02.05.2015.

Graham 2005 – Graham, Paul: How To Fund A Startup. Retrieved: 23.04.2015.

Heskett 2014 – Heskett, James: When Will the Next Dot.com Bubble Burst?. Retrieved: 02.05.2015.

High-Tech Gründerfinds 2015 – High-Tech Gründerfinds: Facts & Figures. Retrieved: 02.05.2015.

KfW 2015 – KfW: Fördergprodukte zum Gründen und Erweitern von Unternehmen. Retrieved: 02.05.2015.

Kollmann 2011 – Kollmann, Tobias: E-Entrepreneurship: Grundlagen der Unternehmensgründung in der Net Economy. 4. Auflage, Gabler Verlag, Wiesbaden.

Lee 2014 – Lee, Timothy: The IPO is dying. Marc Andreessen explains why. Retrieved: 06.05.2015.

Li 2013 – Li, Charmaine: 20 Leading VC Firms Investing In Early-Stage Tech Startups in Europe. Retrieved: 30.04.2015.

Maris 2015 – Maris, Bill: Tech Bubble? Maybe, Maybe Not. Retrieved: 16.04.2015.

Morrill 2015 – Morrill, Danielle: Amid Pre-IPO Mega Deals, Overall Q4 2014 Startup Deal Volume Returns to Late 2011 Levels with Seed Rounds Slowing Dramatically. Retrieved: 31.03.2015.

Paka 2015 – Paka, Amit: The Rise Of Micro Startup Acquisitions. Retrieved: 20.04.2015.

PwC 2015 – PricewaterhouseCoopers, National Venture Capital Association: MoneyTree Report Q4 2014/ Full-year 2014. erschienen Februar 2015. Retrieved: 02.05.2015.

Richter 2014 – Richter, Felix: Startup Funding Shows Signs of New Tech Bubble. Retrieved: 02.05.2015

Ripsas 1997 – Ripsas, Sven: Entrepreneurship als ökonomischer Prozess. Gabler Verlag, Wiesbaden.

Springer 2015 – Axel Springer Plug and Play Accelerator: Q&A for our term sheet. Retrieved: 30.04.2015.

The Economist 2014 – The Economist: Getting up to speed. veröffentlicht in The Economist, January 18th – 24th 2014.

Vital 2013 – Vital, Anna: How funding works : splitting the equity pie with investors. Retrieved: 30.03.2015

Wilson 2014 – Wilson, Fred: The Bubble Question. Retrieved: 02.05.2015.

Figures

Figure 1: 5 Entwicklungsphasen eines Startups nach DSM 2014 – KPMG (Hrsg.): #DSM : Deutscher Startup Monitor 2014. Retrieved: 29.03.2015.

Figure 2: How Startup Funding Works – Vital, Anna: How funding works : splitting the equity pie with investors. Retrieved: 30.03.2015

Figure 3: Funding For Major Startup Stages – own representation, quoted from DSM 2014, Graham 2005, Vital 2013

Figure 4: Startup Funding Shows Signs of New Tech Bubble – Richter, Felix: Startup Funding Shows Signs of New Tech Bubble. Retrieved: 02.05.2015

Figure 5: PwC MoneyTree Report Q4 2014/Full-year 2014 – Investments by industry 2013-2014 – PricewaterhouseCoopers, National Venture Capital Association: MoneyTree Report Q4 2014/ Full-year 2014. published in February 2015. Retrieved: 02.05.2015.

Figure 6: Median post-money valuation of investment rounds – Maris, Bill: Tech Bubble? Maybe, Maybe Not. Retrieved: 16.04.2015.

Figure 7: Late stage valuation compared to VC fundraising – Maris, Bill: Tech Bubble? Maybe, Maybe Not. Retrieved: 16.04.2015.

Figure 8: Years from founding to IPO (mean) – Maris, Bill: Tech Bubble? Maybe, Maybe Not. Retrieved: 16.04.2015.

Figure 9: Number of VC investments – Maris, Bill: Tech Bubble? Maybe, Maybe Not. Retrieved: 16.04.2015.

Figure 10: U.S. Seed Deal Volume Vs. Dollars Invested 2005 – 2014 – Morrill, Danielle: Why Is the Number of Seed Rounds Raised in 2014 Down 30%?. Retrieved: 31.03.2015.

Related