Tag:startup

Recently I received a review copy of Guy Kawasaki latest book, Wise Guy. It is his 14th book and a biographical account of his life combined with tangible key learnings and little pieces of wisdom to be shared. I also reviewed The Art of the Start 2.0 a few years back, so I was happy to be a reviewer again. As most of you know, Guy was chief evangelist of Apple and still keeps busy as an executive fellow at […]

Recently, my thesis from 2016 on Hamburg’s entrepreneurial ecosystem and the regional public policy agenda to foster entrepreneurship was published as an ebook. It is now available on all major platforms, such as Amazon, Apple iBooks, Google Play, Tolino etc. Since this process took a long time, it is not my most recent publication, but still a good reference point about the regional entrepreneurial ecosystem in Hamburg at the time. Abstract: Entrepreneurship, more specifically the formation of tech startups, is […]

Building on research I have done in 2016 at UNSW Business School in Sydney, Australia, my case study about the entrepreneurial ecosystem in Sydney and the regional government’s policy initiatives to nurture the high-growth startup economy has been published as a chapter in the book “Economic Gardening – Entrepreneurship, Innovation and Small Business Ecosystems in Regional, Rural and International Development” as part of their SEAANZ Research Book Series. The case study was first presented as a peer reviewed article at ACERE […]

As far as taking notes go, I am not sure what the best setup might be for me. Although I consider the iPad Pro and Apple Pencil to be the best digital option I have used so far, I was still not getting rid of paper based notes. This is a pain more often than not, since it takes a long time to digitise the notes in an efficient way. This might not be necessary in any case or for […]

Based on research into entrepreneurship policy done at UNSW in 2016, I completed my graduate studies at Hamburg University of Applied Sciences in December 2016 with a master thesis on the entrepreneurial ecosystem in Hamburg, Germany, and the entrepreneurship policy approach by the regional government. The thesis is called “Hamburg’s Entrepreneurial Ecosystem And The Next Media Initiative – Public Policy Towards Entrepreneurship” and focuses on Hamburg’s regional innovation strategy 2020 and the dedicated media/IT industry cluster initiative nextMedia.Hamburg. The abstract of the […]

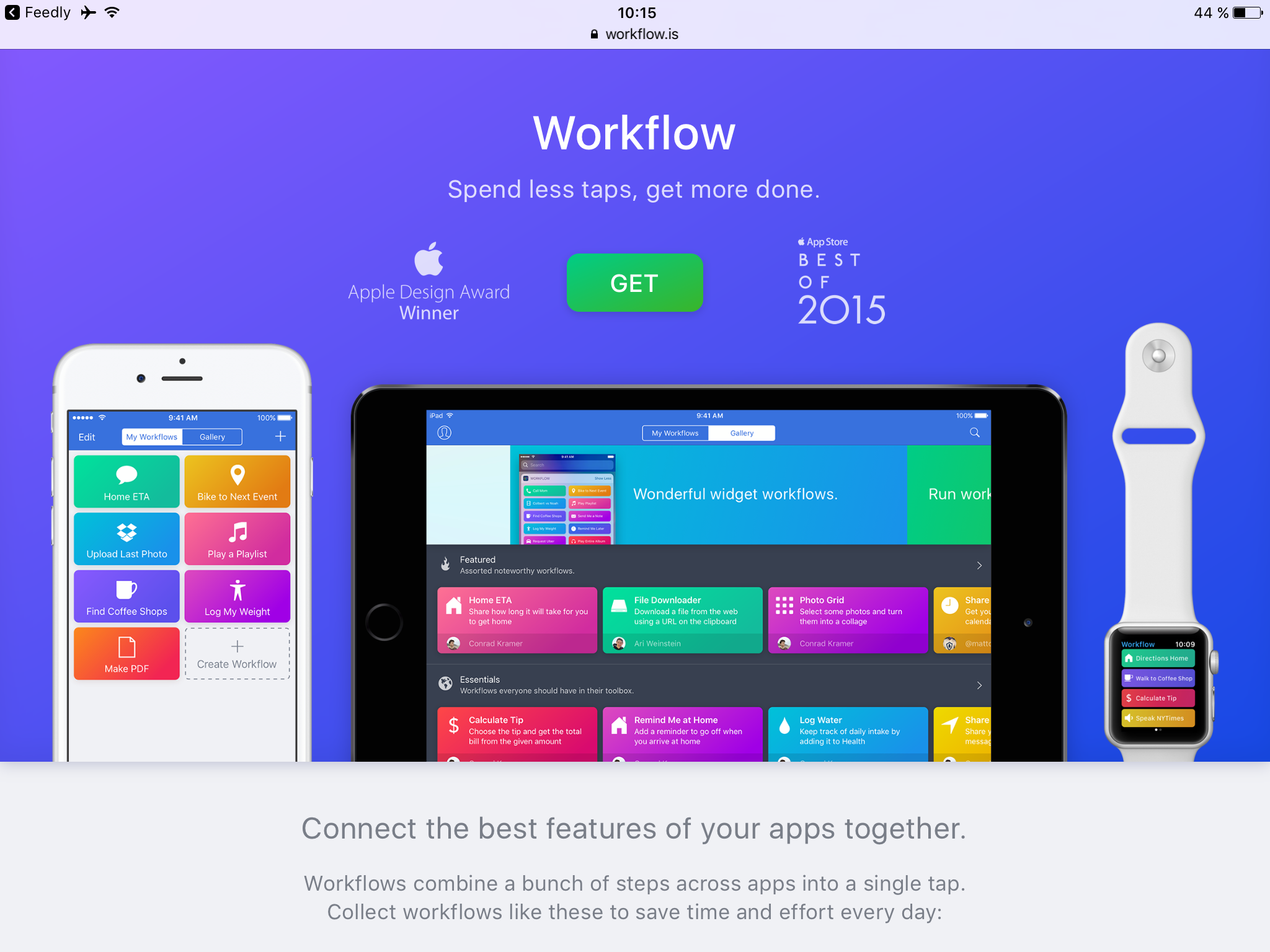

When I was talking about my iPad Pro desktop replacement experiment, I mentioned Workflow, a powerful automation tool I use for tasks of many kinds on the iPad and iPhone. It lets you connect various features of many iOS apps in an easy to use interface that often reminds me of Apple Automator on the Mac, an application that Apple is slowly fading out in my opinion… or at least that is what I thought. As it turned out, Apple […]

During my time at UNSW in 2016, I worked on a case study to review Sydney’s entrepreneurship policy approach. The case study was presented in February 2017 as a peer reviewed paper at the ACERE Conference in Melbourne, Australia. In reviewing the City of Sydney’s Tech Startups Action Plan, a comprehensive document, outlining the city’s strategy towards the entrepreneurial ecosystem and measures undertaken to stimulate its growth, several disconnects between entrepreneurship policy and academic research findings have been discovered: “Abstract: Public policy […]

In February 2017 I attended the ACERE conference 2017 in Melbourne as a speaker to present a case study on the entrepreneurial ecosystem in Sydney and the regional entrepreneurship policy. The paper was created in 2016 during my time at UNSW Business School in Sydney. “ACERE stands for Australian Centre for Entrepreneurship Research Exchange, an annual conference in its 11th year. Initiated by Professor Murray Gillin AM and inspired by the Babson College Entrepreneurship Conference (BCEC) in the United States, […]

In February 2017 I will be at ACERE Conference (Australian Centre for Entrepreneurship Research Exchange) in Melbourne, Australia, to present research findings as a speaker. The conference will be held at NAB’s The Village and is hosted by QUT (Australian Centre for Entrepreneuship Research at Queensland University of Technology) and RMIT University. I worked on a case study of Sydney’s entrepreneurship policy and strategy towards the regional entrepreneurial ecosystem, outlined in the City of Sydney’s Tech Startup Action Plan, a comprehensive […]

During A/D/A Hamburg I joined new media artist Jeremy Bailey as a mentor for his 3 day Lean Artist seed accelerator workshop. It basically was a boot camp based on design thinking and lean startup principles to create culturally disruptive startups. On the first day I joined the selected group of 10 international artists with a cynical review of the worldwide startup economy to promote a more creative approach to generating relevant startup ideas. Jeremy kicked the event off with an accelerated […]